#Bookkeeping vs accounting software#

On the other hand, with electronic bookkeeping or accounting software, the transactions are recorded automatically using computer software or home-based computer systems.

#Bookkeeping vs accounting manual#

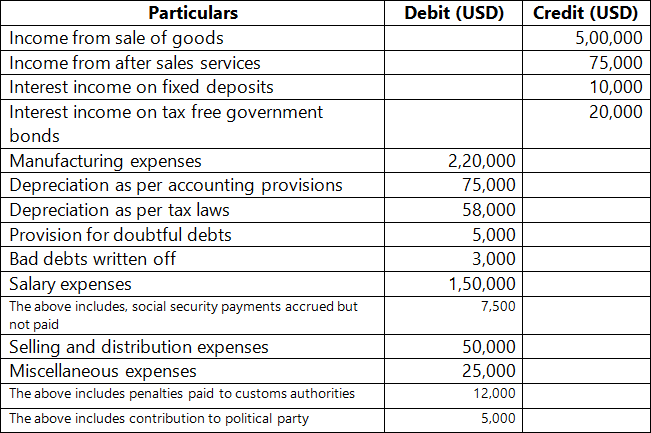

With a manual bookkeeping system, all financial transactions undertaken by an individual are recorded in a specific format to be easily understood. It has two different forms:Ģ)Electronic Bookkeeping & Accounting Software To perform advanced bookkeeping, companies must maintain separate books for each type of transaction within the industry because it has various types of accounts.Įven though additional records are added as well to this system, they are not considered a different part of the primary bookkeeping system.īasic bookkeeping is mainly used for small business owners or self-employed individuals.Īlso Read: Best Ways To Manage Accounts And Data For e-Commerce Sellers Significance of Bookkeeping:īookkeeping plays a significant role in the life of the individual and an organization because it is the single method through which all financial transactions occur. Basic bookkeeping is used for simple companies and those with small operations.Īdvanced bookkeeping helps in doing calculations, accounting, budgeting, and other significant functions associated with a business. For companies operating in different states, which may include interstate and international commerce, records must be maintained to take necessary action if there are any discrepancies.Īlso Read: What Are The Best Accounting Practices For Small Businesses? Types of Bookkeeping:īasic bookkeeping is the system in which all information related to the financial transactions of a business is recorded in a way that the accountant or auditor can quickly identify. In certain situations where a company is involved in foreign exchange transactions, bank statements will be critical. Similarly, companies will also have to keep track of employees’ salaries and other benefits. In addition to this, records must be kept for customers if they require some services or products. In such cases, it is necessary to maintain a detailed record of the purchase order or invoice so that the business can produce its products.

These records will also include invoices and purchase orders.Īt some point, the business may need to expand its output by purchasing additional items for inventory.

These three books are also referred to as running books. Companies generally maintain three different books: The main idea behind bookkeeping alone is to keep track of physical assets so that the business can trace its financial transactions. As opposed to accounting, all financial transactions are summarized and summarized in one organized way. All these steps are performed manually or electronically with the help of software.Īlso Read: Types of Accounts in Accounting What Is Bookkeeping?īookkeeping (also known as Cash Book or Ledger) is the system by which individual items of sales, purchases, and assets are recorded in a particular format to be easily retrieved again. Recording a transaction seems simple, but that involves planning, collecting information, coding, recording, verifying, and summarizing the data into an understandable form. Bookkeeping helps to protect the organization from fraud by making an audit trail. Bookkeeping helps in identifying the revenue and expenses that a company incurs.īookkeeping helps prepare financial statements, which are used for analysis purposes and to predict future results. Bookkeeping is an integral part of accounting which is necessary because it helps keep the records of financial transactions involved in the business. On the other hand, accounting records are meant to be used for planning and decision-making purposes. Bookkeeping is the process of recording and summarizing the financial information about a business to make it understandable.

0 kommentar(er)

0 kommentar(er)